Bain: Digital consumers turning backs on primary banks

Banks around the world have upped their game and improved their apps and websites – a welcome digital transformation ahead of the pandemic, especially as branch visits dropped and consumers required digital solutions.

However, it is not all good news for these ‘traditional’ banks, as many of their customers have been ‘defecting’ to competitors – both traditional and digital disruptors.

According to Bain’s NPS® 2020 survey of about 56,000 consumers in 11 countries, 25% to 51% of all banking product purchases, depending on the country surveyed, go to banks that aren’t the respondent’s primary bank.

Although those primary banks may still handle deposits and checking account, those customers are shopping around for high-margin products like loans, credit cards and investments.

What causes customers to defect to another bank?

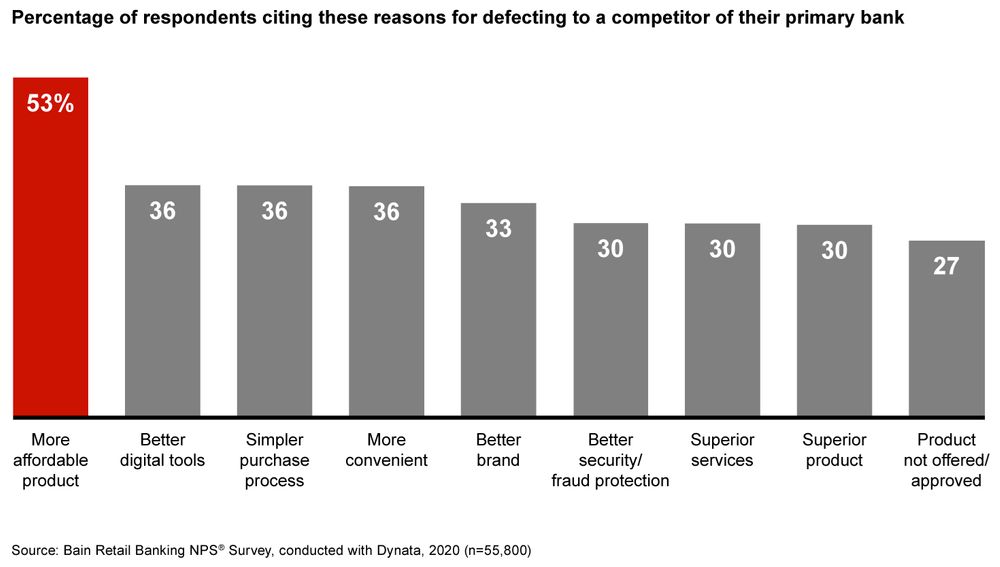

Bain’s extensive survey suggests there is no single reason why these customers defect, although affordability, convenience, and a better digital experience are all cited. Younger customers in particular put a greater emphasis on digital tools, convenience, branding and security.

The UK, which has one of the most competitive markets, has the highest defection rate of the countries surveyed. As consumer-friendly regulation takes hold in more countries, competition in those markets could also intensify. Banks in fragmented markets (including the US and Germany) need to act now to avoid losing business from banking defectors.

The good news for those banks from the survey is that of those 29% who defected having received an offer from a competitor, 78% said they would buy from their primary bank if they made a ‘compelling or equivalent’ offer. This percentage was even higher for savvy younger customers less aligned to brand loyalties.

Customers tend to stick with primary banks for their core needs but many banks do not properly leverage that relationship by delivering more value through personalised products. Providing a seamless digital experience and good value products in a tailored fashion will help retain those customers and improve sales.

- Top 10 leading digital transformation providers in SaudiDigital Strategy

- Santander Portugal CEO promoted to regional head for EuropeLeadership & Strategy

- Abu Dhabi Finance Week: 10 speakers you don’t want to missCorporate Finance

- HSBC Middle East building on 134 years of banking legacyLeadership & Strategy